Allocation Of Refund 5,0/5 7583 reviews

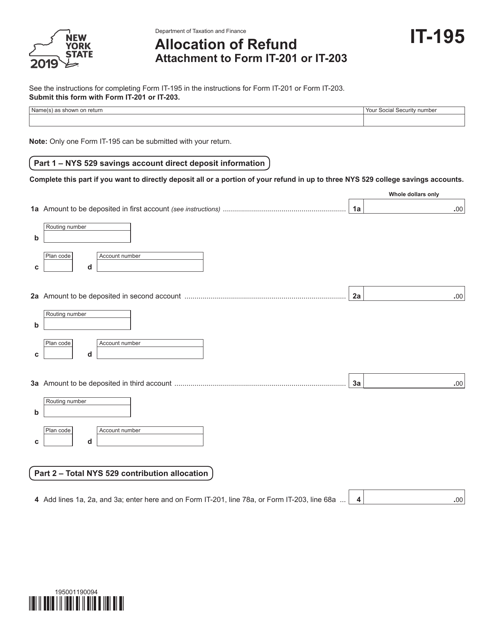

- IT-195, Allocation of Refund, (Attachment to Form IT-201 or IT-203) IT-227, New York State Voluntary Contributions; IT-558, New York State Adjustments due to Decoupling from the IRC, and instructions; Common credit forms. IT-215, Claim for Earned Income Credit, and instructions; IT-216, Claim for Child and Dependent Care Credit, and instructions.

- We last updated the Allocation of Refund (Including Savings Bond Purchases) in January 2021, so this is the latest version of Form 8888, fully updated for tax year 2020. You can download or print current or past-year PDFs of Form 8888 directly from TaxFormFinder. You can print other Federal tax forms here. EFile your Federal tax return now.

- Allocation Refund Direct Service

- Allocation Of Refund 8888

- Allocation Of Refund Irs

- 888 Allocation Of Refund

Assume you receive the average refund of $2,925 in February 2014, instead of spending it all in one or two months, place the whole refund in a high-yield savings account (more interest than a traditional financial institution) and draw off the refund each month over a ten month period ($292.50 per month). Use the Form 8888, Allocation of Refund (Including Savings Bond Purchase) PDF to split your refund. See Frequently Asked Questions about Splitting Federal Income Tax Returns for more information. Direct Deposit Your Refund to a Single Checking or Savings Account. Federal Department of Allocation Refund Facebook Organisation promotion program and the department of workers compensation appeals Board. Jeff ronk Meyer claim agent Gary Shumaker setup person - never meet this person says he graduate of my old High school. They said i was a winner of The United States of America Allocation Refund.

Nonresident and part-year resident income tax returns

- IT-203, Nonresident and Part-Year Resident Income Tax Return, and instructions (including instructions for IT-195, IT-203-ATT, and IT-203-B)

- IT-203-X, Amended Nonresident and Part-Year Resident Income Tax Return and instructions

Allocation Refund Direct Service

Other forms you may need to complete and submit with your return

Allocation Of Refund 8888

- IT-203-ATT, Other Tax Credits and Taxes(Attachment to Form IT-203)

- IT-203-B, Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet

- IT-203-C, Nonresident or Part-Year Resident Spouse's Certification

- IT-196, New York Resident, Nonresident, and Part-Year Resident Itemized Deductions

- IT-201-V, Payment Voucher for Income Tax Returns

- IT-225, New York State Modifications, and instructions

- IT-2, Summary of W-2 Statements

- IT-1099-R, Summary of Federal Form 1099-R Statements

- IT-195, Allocation of Refund, (Attachment to Form IT-201 or IT-203)

- IT-227, New York State Voluntary Contributions

- IT-558, New York State Adjustments due to Decoupling from the IRC, and instructions

Common credit forms

- IT-215, Claim for Earned Income Credit, and instructions

- IT-216, Claim for Child and Dependent Care Credit, and instructions

See our Income tax credits page for general information on the common credits listed above.

Allocation Of Refund Irs

See our Income tax forms page for other personal income tax forms you may need.